Programmatic M&A explores a systematic approach to multiple, minor, or moderate deals often focussed on a particular theme or sector. The end goal might be financial growth, but for the clients or companies choosing this method, increasing capabilities and services and building competitive advantage are desirable long-term outcomes.

As a result, programmatic dealmaking is extolled as a way to stay ahead of the competition, and as such, the payoffs for optimising workflows and processes are enhanced. For dealmakers running multiple deals successfully, the benefits include improved agility, rationalised strategies and resources, optimised budgeting and creating a tailored M&A blueprint.

'Our more than two decades of research shows that ‘through-cycle' programmatic M&A' – making many relatively small transactions as part of deliberate and systematic M&A programs delivers far more total returns to shareholders on average than other approaches including organic growth and 'big bang' deals.

Despite the potential for significant rewards, managing multiple deals presents many challenges. Deal overload can create numerous conflicting deadlines and resources stretched beyond their limit. Managing user access, secure document sharing, and multiple due diligence phases simultaneously can prove too much, leading to deal abandonment or breakdown.

How VDRs support multiple deals

When the stakes are this high, using tools and systems designed to ease bottlenecks, increase security and minimise time spent on administrative tasks is critical. Virtual Data Rooms (VDRs) have long been an essential tool for dealmakers, but increasingly, they are relied upon to simplify the impact of multiple deals on teams, resources and timelines. Let's explore how.

Centralised document management

A VDR is a central hub for storing and organising all deal-related documents. With multiple deals in progress, having a single, secure repository for documents ensures easy access and prevents information silos. Team members, both internal and external, can collaborate seamlessly, leading to improved communication and reduced chances of errors.

Keeping documents for each potential deal separate yet accessible in the same software also smooths workflows and reduces the time spent storing, sharing, and quickly locating specific data.

Enhanced security

Managing sensitive information for multiple deals requires robust security measures. VDRs provide advanced encryption, access controls, and other security features that safeguard confidential data.

At a minimum, VDRs should comply with ISO 27001, the international standard for information security management, and GDPR, a legal requirement when handling personal data within EU countries. Outside of the EU, many equivalent data privacy regulations may also impact the territories of the deal parties. At Admincontrol, we comply with the requirements of these regulations together with an additional voluntary compliance standard for managing sensitive data, SOC 2.

When managing concurrent deals, the volume of sensitive information, confidential documentation and personal data is multiplied. Keeping track of who has access to what and in what jurisdiction is made much more straightforward when working within a VDR environment. This is crucial when dealing with various stakeholders, such as investors, legal teams, and potential partners, each requiring access to specific documents at a particular time.

User permission control

Different deals involve parties with distinct roles and responsibilities. Even for smaller deals, both parties will add external advisors such as tax experts, legal counsel and financial consultants to the internal personnel managing a transaction. Keeping track of who can access specific folders and documents inside the data room is fundamental to a deal's ongoing security and viability since a data breach is a frequent reason for deal failure or at least a considerably reduced sale price.

Data breaches discovered during and after a corporate transaction can significantly impact a deal and the companies involved. For example, in 2016, a pair of data breaches that were identified prior to finalising the acquisition of Yahoo by Verizon caused the sellers to lower the purchase price by $350 million USD.

Audit trails for accountability

Tracking changes and document access is essential for accountability and compliance. Alongside granular user permissions, a VDR helps ensure that individuals only access information relevant to their role. This can include who can download documents or print them, for example.

While some deals may require the additional reassurance of a clean room, VDRs still safeguard access with a detailed audit trail of all user activities within the platform. This proves invaluable when managing multiple deals, making it straightforward to track who is doing what whilst juggling different transactions and organisational types.

Efficient due diligence

Due diligence is critical to every transaction, but managing it across multiple deals without the right tools can be overwhelming. VDRs streamline the due diligence process by providing a structured environment for organising documents, facilitating Q&A, and enabling seamless communication between parties. Redaction tools are an added feature to remove or mask sensitive information, providing a simple way to manage every document appropriately regardless of the number of parties or deals.

Time-saving collaboration

Real-time collaboration features within VDRs, such as commenting, annotation, and task assignment, enhance communication and streamline workflows. Secure messaging features ensure collaboration and discussion can happen within the safety of the data room and remove the need to bounce from one piece of software to another. Furthermore, sending questions, responses and documents via insecure email programs, either internally or externally, creates a considerable security risk of data loss, breach or theft.

For dealmakers, these tools foster collaboration among team members, advisors, and other stakeholders, reducing the time needed to reach consensus and make informed decisions.

Whilst the features we've described above are integral to VDRs, the issue of managing multiple data rooms across numerous deals remains. Data room administrators and deal teams must spread their focus and effort across various data rooms to ensure that the sensitive information they contain is secure and precise. The need for document management and information sharing is critical to a successful deal outcome, yet for multiple transactions, this means duplication of effort and resources staying on track.

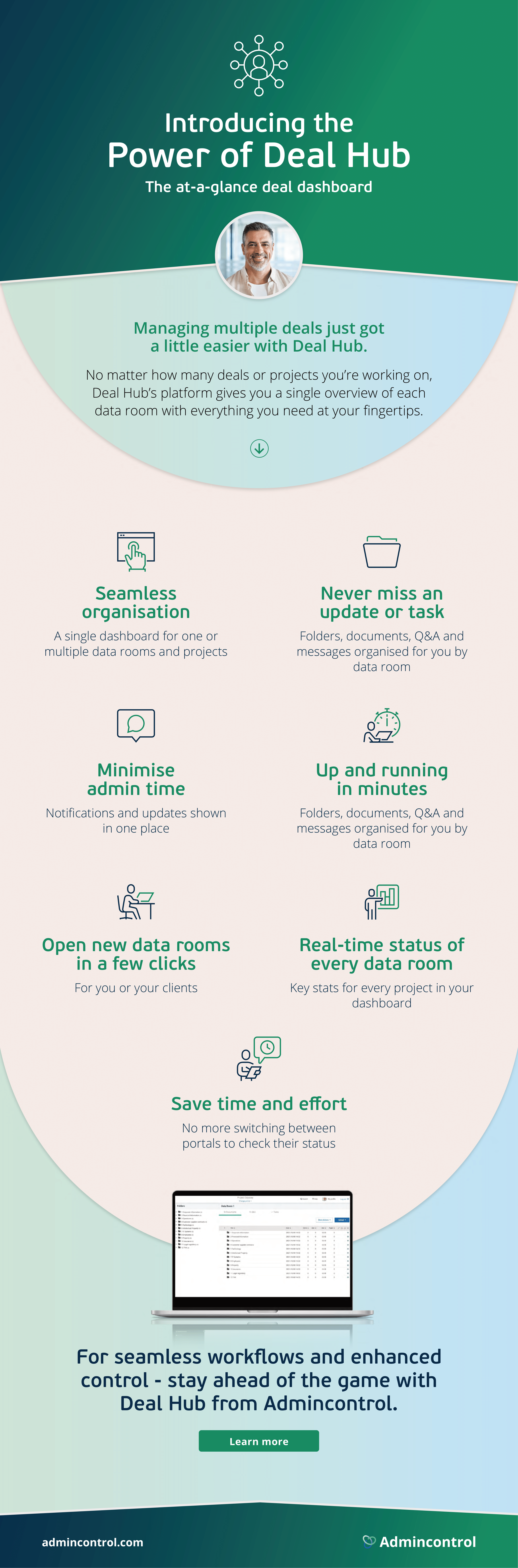

It's why some VDR providers are adding single-access platforms that manage and protect each deal in its own right but from one access point. Sound complicated? We promise it's not. In fact, for dealmakers involved in programmatic or concurrent projects, it's a game-changer.

A single-view platform to manage multiple data rooms

Imagine a dashboard directly linking to every data room currently in use, with critical insights, task summaries and a snapshot of the actions required. Instead of accessing multiple data rooms separately to trawl through the latest questions to be responded to or to check on the status of a legal discussion, the dashboard brings together critical information for review in one place. This helps dealmakers to stay on top of multiple deals and reduces effort and duplication of tasks. It also means data room administrators have oversight of deal status to feel more in control of processes and deadlines.

Plus, as you need to open new data rooms, this can be done within the dashboard in a few clicks so that a data room is set up and ready to use more quickly. At Admincontrol, our Deal Hub platform provides this tailored and streamlined overview of data rooms. It is available to those opening data rooms for their organisation or on behalf of their clients, too.

In summary

The art of managing multiple deals is a partnership between intuitive, secure and efficient technologies and dealmakers. While a concurrent or consecutive deals programme is always complex and challenging, VDR technology designed to speed up and streamline critical workflows will support more efficient outcomes.

VDRs have emerged as a vital tool in this process. However, as technology and dealmaking evolve, leveraging new capabilities, such as dynamic platforms to manage multiple data rooms and deals, brings unique benefits and opportunities. Ultimately, the end game must be navigating deals confidently, with the increased workload that comes with programmatic M&As managed effectively. The nature of complex deals means the process will never be effortless. Still, technology does empower dealmakers to focus their efforts more on strategic matters and less on juggling data rooms, software and administrative processes.

Want to learn more?

Get a demo of our virtual data room and Deal Hub, the single platform for managing multiple deals and data rooms: