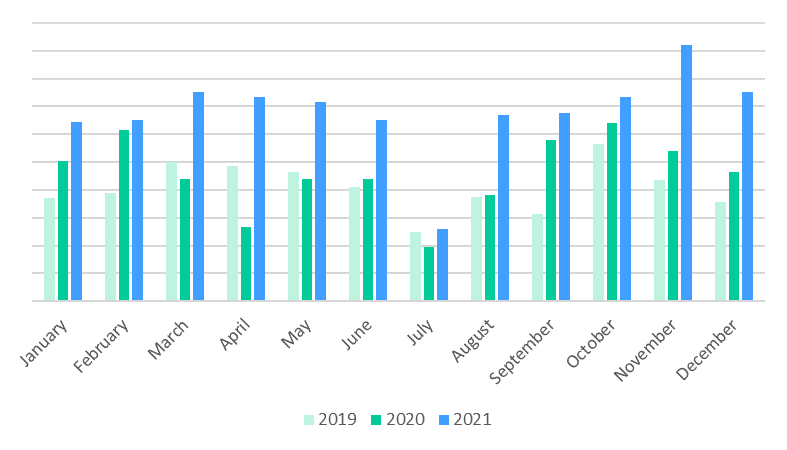

With aggregate data statistics from our solution, we can extract valuable insights. In this report, we share our most important findings from the Q4 2021, as well as our predictions for the start of next year.

Boom in deal making

This reflects the continued boom in deal making, as well as Admincontrol’s growth, as we are expanding into new markets such as the Netherlands and the UK.

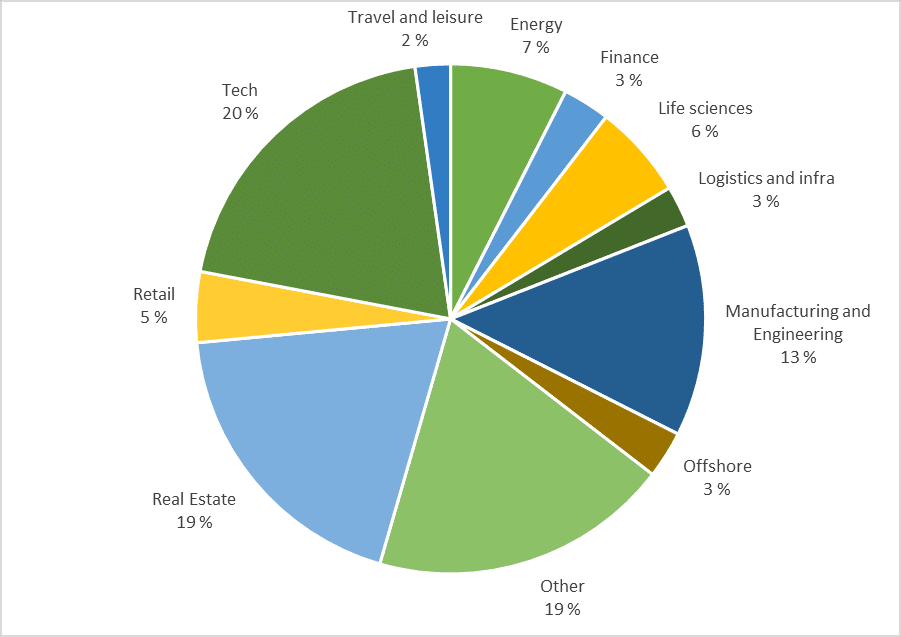

Looking at the industries that drive activities, tech and life sciences continue to fuel the high activity levels. We also see that the number of real estate deals has increased from already high levels earlier this year.

The illustration below shows the industry breakdown of new portals opened during Q4 2021. The chart includes data from which the industry can be derived, including around two thirds of the data set.

New trends: consolidation, security, sustainability, and climate control

Throughout 2021 we have reported high levels of activity within tech, life sciences, energy, and real estate.

All of the sectors are still active particularly tech, which is up from 17 % to 20 % of our total deal volume on our platform.

However, looking more closely at the figures there are four interesting findings:

1. Sustainable energy deals

There has been a small reduction in the number of data rooms opened by energy companies on our platform. This segment, which has remained strong throughout 2021, decreased from 10 % of total deals on our platform in Q3 to 7 % in Q4.

When looking more closely at the details of energy deals, we see that 70 % of the target companies that opened data rooms in Q4 were sustainable energy companies, which is not surprising, considering the efforts of large parts of the energy sector regarding transformation and the green shift.

2. Consolidation

When looking at general trends across sectors, we see a higher activity level than usual among smaller companies in certain subsectors. Some examples include electrical companies, small retailers, and manufacturers. Overall, there would appear to be a high volume of consolidation activities in which larger companies incorporate smaller competitors.

3. Climate control – and more consolidation

Deals from companies in the climate control industry have been growing steadily in recent month. In Q4, we have seen a real boom in this subsector, with an extraordinarily high level of activity. Could this industry also be experiencing a wave of consolidation?

4. Security

We see an increase in activity in which the target companies operate within tech and consultancy where security is the key value driver. Security is a hot topic, and this also seems to apply when it comes to deals.

Expectations for 2022

As we approach year end, we always see a rush to close deals before the holiday break. This year is no exception. However, we have also noted that many data rooms on our platform are in preparation mode. – meaning that target companies are preparing for due diligence at the start of 2022.

One of the trends in 2021 was an increase in the number of IPOs. We predict a slowdown in IPOs in the coming years.

However, we see no sign of a slowdown in deals, and we expect that tech, the energy transition, the ongoing consolidation trend, and an active real estate market will sustain the M&A wave well into 2022.