As a leading provider of data rooms, at Admincontrol we are close to hundreds of M&A due diligence processes every month. We also gather quarterly statistics from our platform to provide us with valuable insights on what’s going on in the market.

In this blog post, I will share the key trends that we saw develop over 2021 and use these insights to predict where the market is likely to head next.

Deal-making activity increases throughout the year

In 2021, we opened more than 1,500 data rooms on our platform, facilitated around 700 live due diligence processes and supported 150+ data rooms in preparation mode. Overall this means more than half of the data rooms that we initiated last year are now being prepared for due diligence or have already gone live – a sure sign of a buoyant market.

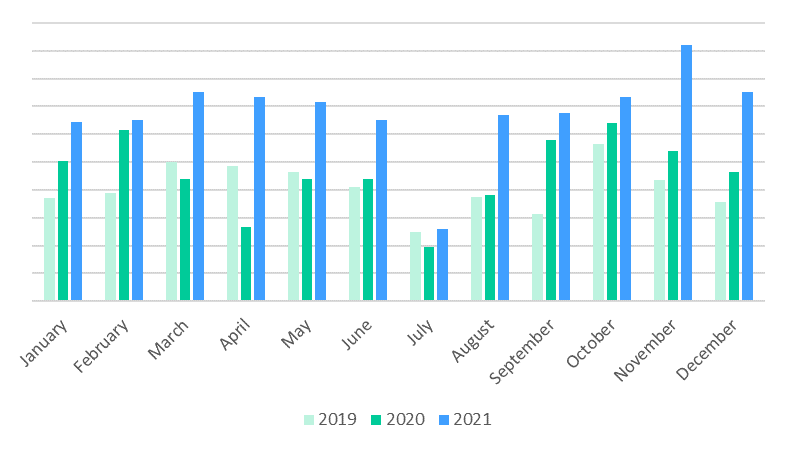

As the chart below shows, the number of new data rooms we opened overall comfortably outstripped the pre-pandemic activity levels we saw in 2019 and represented a 46% increase compared to 2020.

Partly this growth can be attributed to the general growth that Admincontrol is experiencing as a company, especially in new markets like the UK and the Netherlands. But it is also undoubtedly related to the record level of M&A in 2021 that has been widely reported elsewhere by respected sources like KPMG and PwC.

Tech, real estate and energy sectors lead the way

Throughout 2021 our quarterly data trends reports showed that a new wave of deals was being driven by high activity in a broad number of sectors – but especially within the technology, real estate and energy sectors.

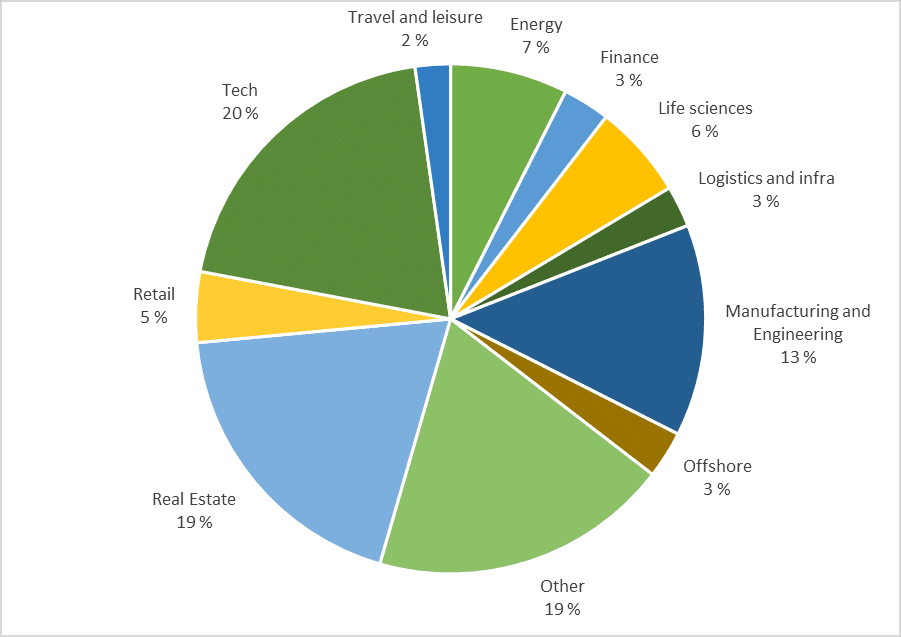

The illustration below shows the number of new data rooms that were opened by sector in Q4 2021.

We can expect the growth of deal preparation in these sectors to continue in 2022, especially with the sustained investment in technology required to drive digital transformation, the continued rise in real estate prices and the ongoing drive towards decarbonisation in the energy sector. In the case of the latter, we saw that 70% of the target companies opening data rooms in Q4 were sustainable energy companies.

In addition we also saw increased activity on our platform from:

- Life sciences companies focused on the development of medicines and healthcare technologies

- Consultancies and technology companies that focus on cybersecurity

- Educational technology companies that provide remote learning and development tools

- Heating, ventilation and air conditioning (HVAC) businesses in the climate control industry

In a post-pandemic world that requires more efficient solutions for healthcare, more eco-friendly systems and better support for remote and hybrid working, these are trends that are likely to continue into 2022.

IPOs rise then flatten out

At the start of 2021 the number of companies that went public rose sharply compared to the numbers in 2020. At Admincontrol we saw an increasing number of portals on our platform being used for planning an upcoming initial public offering (IPO).

This trend remained strong throughout the middle section of the year. By Q4, however, activity had leveled off and we now see no signs that the upward trend in IPOs will continue into this year.

However, we’re not seeing a similar slowdown in M&A deals, and we expect that the demand for new technology, the energy transition and a hot real estate market will sustain the M&A wave well into 2022.

Digital solutions for due diligence take off

In the wake of the pandemic, one of the other major trends we saw in 2021 was an acceleration of the adoption of digital solutions to power the end-to-end due diligence process. One of the first signs of this trend came in Q1 when we saw our customers really starting to embrace our data room webshop.

You can visit our webshop, here.

The webshop is designed to further speed up the process of digital due diligence by giving M&A teams instant access to the data rooms and tools that we offer, such as our Folder Wizard for creating a folder structure, and our Task Manager functionality that facilitates the upload process.

Uptake of these features was particularly strong last year in the Nordic regions, where adoption of data rooms is already high. However we also reported in Q2 that sales through our webshop were also increasing in markets such as the Netherlands that have traditionally had a lower adoption rate.

During 2021 the traffic via our webshop more than doubled, and now represents almost 20 % of overall sales. In the near future, we predict that up to 90% of our sales will be via the webshop – driven by customers opting for premium and easily accessible digital solutions in favor of generic tools like low-cost file sharing solutions.

What’s next?

As we step further into 2022, we expect ongoing deal-making in the technology, real estate and energy sectors in particular to continue to overshadow IPO activity. There are also indications within our data that the M&A market will be fuelled further by a trend towards consolidation as larger companies seek to acquire smaller businesses, especially in areas like retail and manufacturing.

In addition, we are also likely to see a further increase in the adoption of digital data rooms and tools as M&A teams look for new ways to handle increasing workloads, increase the efficiency of the review process, get deals done faster and cope with the new reality of having to work and collaborate with all relevant parties remotely.

As ever, we’ll keep you updated on how things are panning out with our quarterly trends reports throughout the year.